Malaysia beat out countries like Australia and the United Kingdom to claim this spot. Learn more at goIndiGoin.

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017.

. No penalty as such. The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

Name of the Act Late fees for every day of delay. 31 GST on the Supply of Goods and Services in Singapore 311 For GST to be chargeable on a supply of goods or services the following four. The GST chargeable on the acquisition of the goods and services can be redeemed against the GST chargeable on the supply of the goods and services the vendor will have to make payment of the GST on the applicable rate but he can claim it back via the tax credit method.

Sales and Service Tax SST in Malaysia. GST Claim Form for online bookings GST Claim Form for online bookings 03 Aug 2020 1600 IST. 1 the supply of goods and services in Singapore and 2 the importation of goods into Singapore.

Malaysia has a strong educated workforce and English is widely used as a business language. Central Goods and Services Act 2017. A GST registered entity who makes zero-rated supplies is able to claim the input tax paid on purchases.

For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. According to the GST Legislation a late fee is an amount imposed for late filing of GST Returns. West peninsular Malaysia shares a land border with Thailand and there are two bridges that connect Malaysia to the island of Singapore and has coastlines on the South China Sea and the Straits of Malacca.

When a GST Registered business fails to file GST Returns by the prescribed due dates a prescribed late fee. Rs 25 Total late fees to be paid per day. General Information on GST Return Late Fees.

For all other back taxes or previous tax years its too. The scope of GST is provided for under Section 7 of the GST Act. Malaysia has a well-developed infrastructure.

Read from the list of frequently asked questions about refunds related issues and get support on refund for a cancelled ticket. Penalty for delay in payment of invoice. Hong Kong pre-arrival registration for Indian Nationals effective 23rd January 2017.

Penalty for incorrect filing of GST return. ITC will be reversed if not paid within 6 months. It may be a good idea to speak with an experienced tax attorney or CPA before amending or filing old returns.

Further the GST has replaced many indirect taxes such as excise duty value added tax VAT service tax etc. Theres no time limit for submitting a previously unfiled return. GST or the goods and service tax is a comprehensive multi-stage and destination-based tax levied on every value addition.

We work out the excise refund on the quantity of fuel you purchased not the cost of the fuel. You can claim a refund of the GST and excise included in the purchase price of alcohol tobacco and fuel even if your tax invoice is for less than 200 including GST. Pay the correct GST and get a refund of the wrong type of GST paid earlier.

Exports of goods and provision of international services are mainly zero-rated supplies. It came into effect from July 1. GST law applies as a single domestic indirect tax law for the entire country.

Penalty for wrongfully charging GST rate charging. E Filing Income. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline.

Check Income Tax Refund Status Online. But interest 18 on shortfall amount. However if youd like to claim your refund you have up to 3 years from the due date of the return.

GST is imposed on. Hong Kong pre-arrival registration for Indian Nationals effective 23rd January 2017. Get business latest news breaking news latest updates live news top headlines latest finance news breaking business news top news of the day and more at Business Standard.

Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. You may want to file your old returns before a demand is made. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018.

Malaysia is a country in Southeast Asia located partly on a peninsula of the Asian mainland and partly on the northern third of the island of Borneo. GST is not chargeable on exempt supplies of which there are two categories sale and lease of residential land.

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

How To Collect Gst Tax Refund Eztax

Tourist Refund Scheme How To Claim Trs Airport Refund On Australia Gst Thinkmaverick

How To Claim Gst In Malaysia Tips Tips Wonderful Malaysia

How To Claim Income Tax Refund Online Enterslice

Guide To Gst Refund In Australia Bragmybag

How To Claim Back Gst Gst Bas Guide Xero Au

Refund Under Gst All You Need To Know Quickbooks

How To Get Gst Tax Refund Before Leaving Singapore Changi Airport Or Cruise Terminal Understand What Is Gst Sal Singapore Changi Airport Singapore Travel Tips

How To Claim Gst In Malaysia Tips Tips Wonderful Malaysia

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

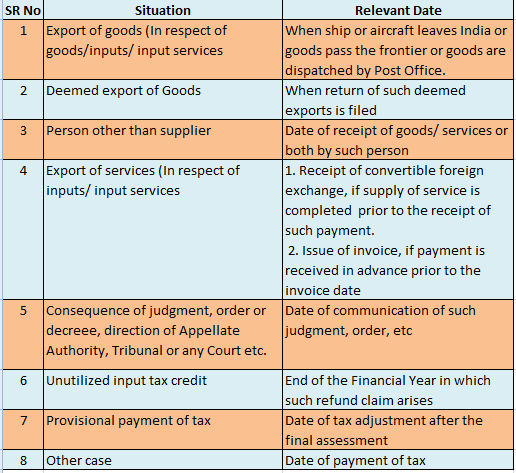

Claiming Gst Refund As An Exporter Here S What You Need To Know

How To Get Gst Refund Indiafilings

Tourist Refund Scheme How To Claim Trs Airport Refund On Australia Gst Thinkmaverick

Malaysia Sst Sales And Service Tax A Complete Guide

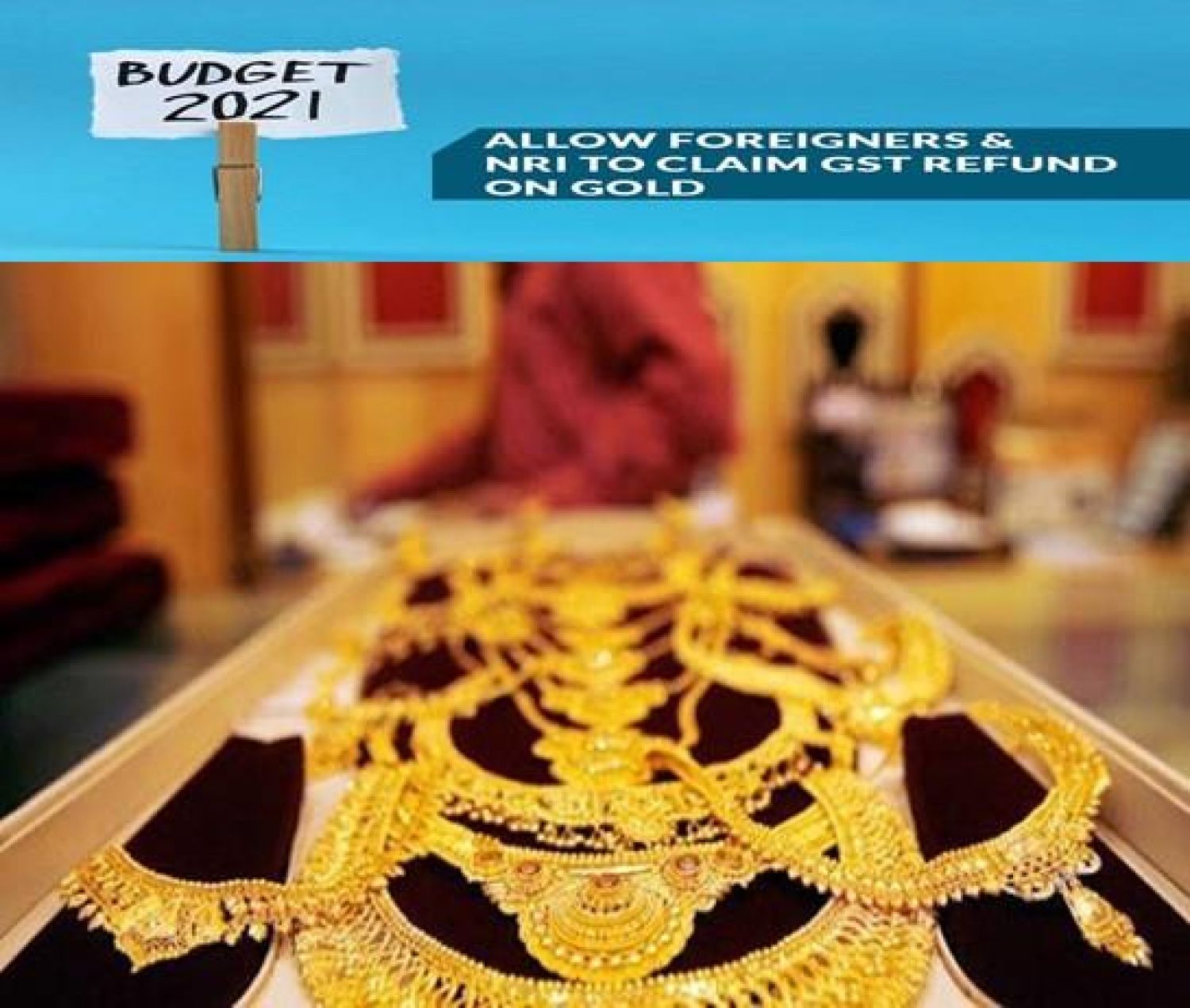

Allow Nris To Buy Gold From Foreigners To Claim Gst Refund

Allow Nris Foreigners Buying Gold To Claim Gst Refund On Their Return

How To Claim The Gst Refund For The Things Purchased If I Come To India As A Tourist Quora

Guide To Tax Refund In Malaysia Bragmybag